CURRENTLY, THE RESEARCH CHALLENGE IS

Banking systems' inherent lack of accessibility for specially-abled individuals, so,

How can we reimagine Banking ecosystem and onboarding flows to ensure

inclusiveness and accessibility for all users, especially abled individuals? The challenge is to design

these critical entry points to be robustly secure yet intuitively usable, fostering true financial

independence for everyone.

☒Unintuitive navigation

☒Unclear information hierarchy

☒ Inconsistent design elements

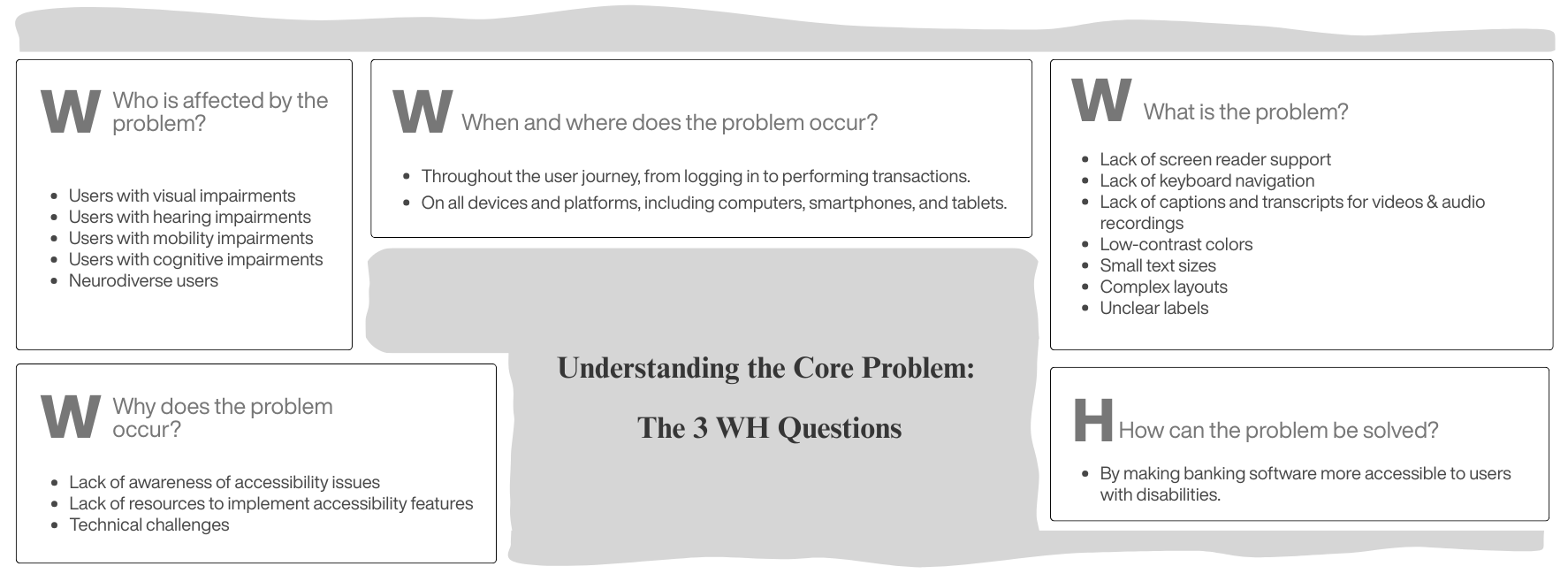

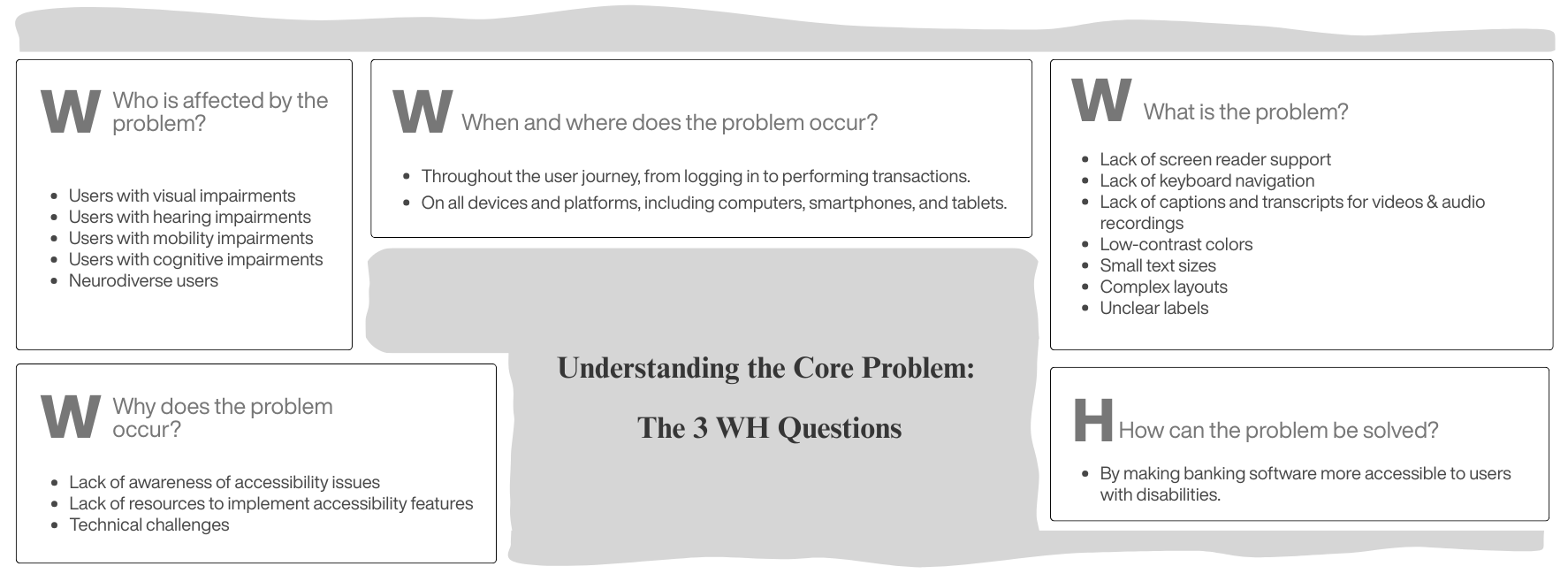

Understanding WH Questions

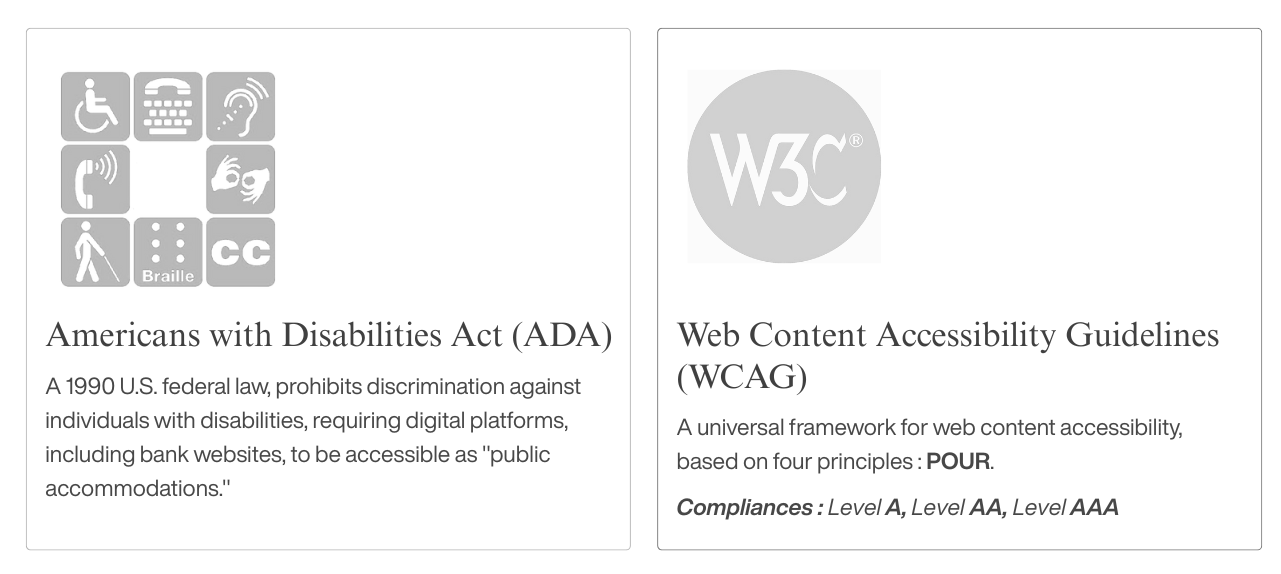

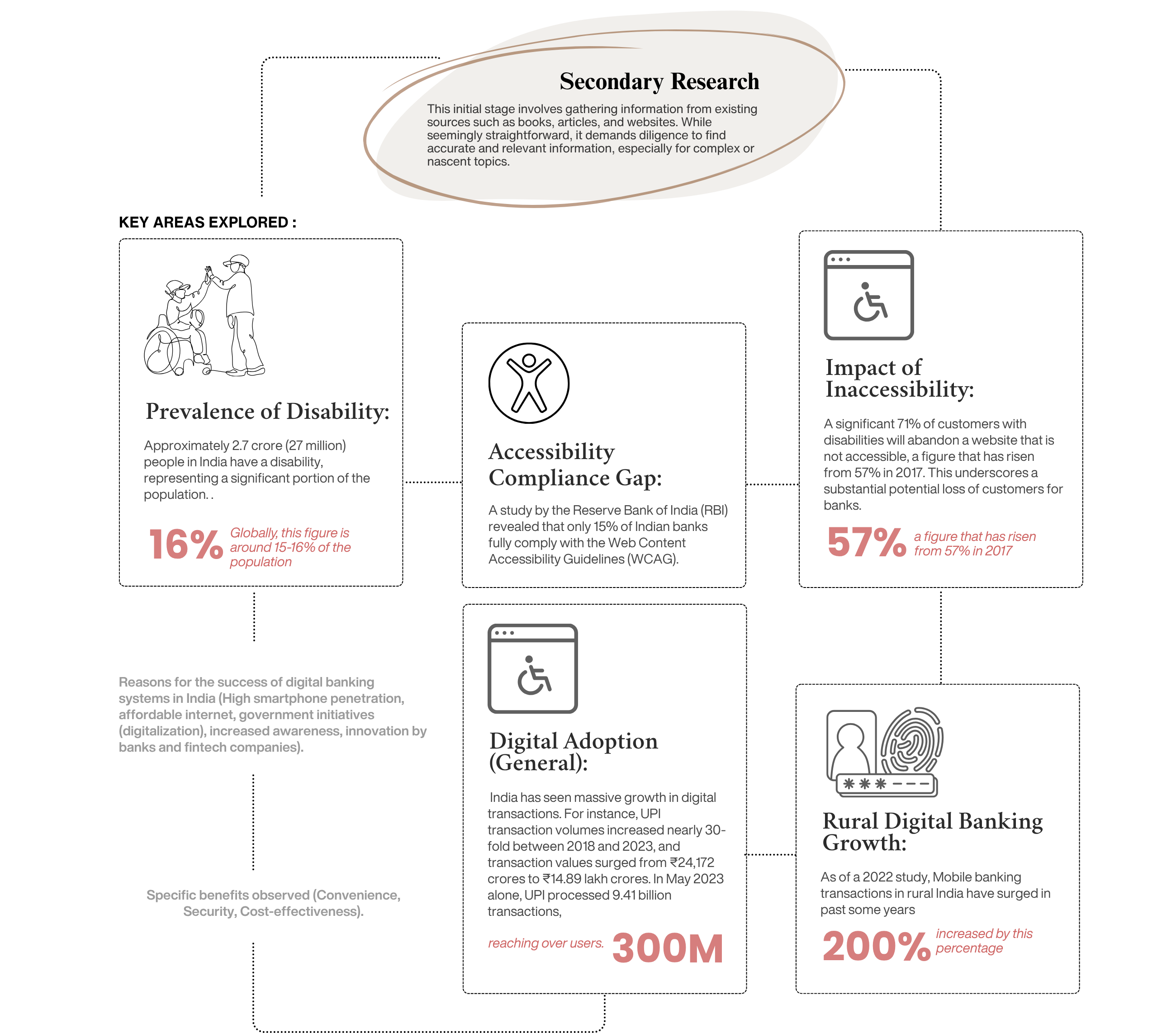

CLARIFYING EXISTING DIGITAL ACCESSIBILITY GUIDELINES AND DIVERSE USER NEEDS

Digital accessibility isn't merely a feature; it's a fundamental commitment!

Its importance is underscored by the fact that roughly 16% of

the world's

population identifies as differently-abled. Failing to design with their needs in mind can

inadvertenFtly deny them basic human rights, particularly access to essential services.

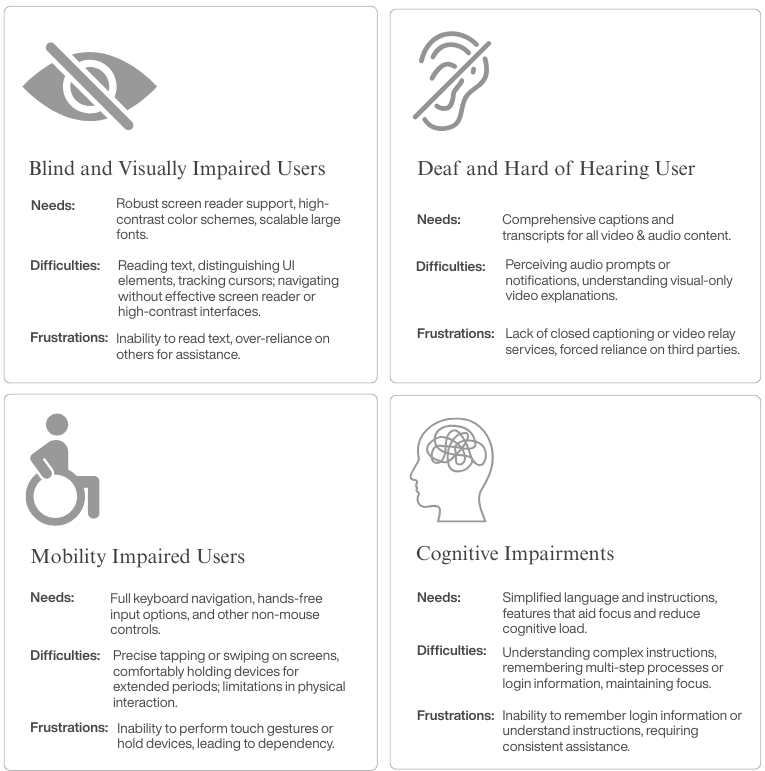

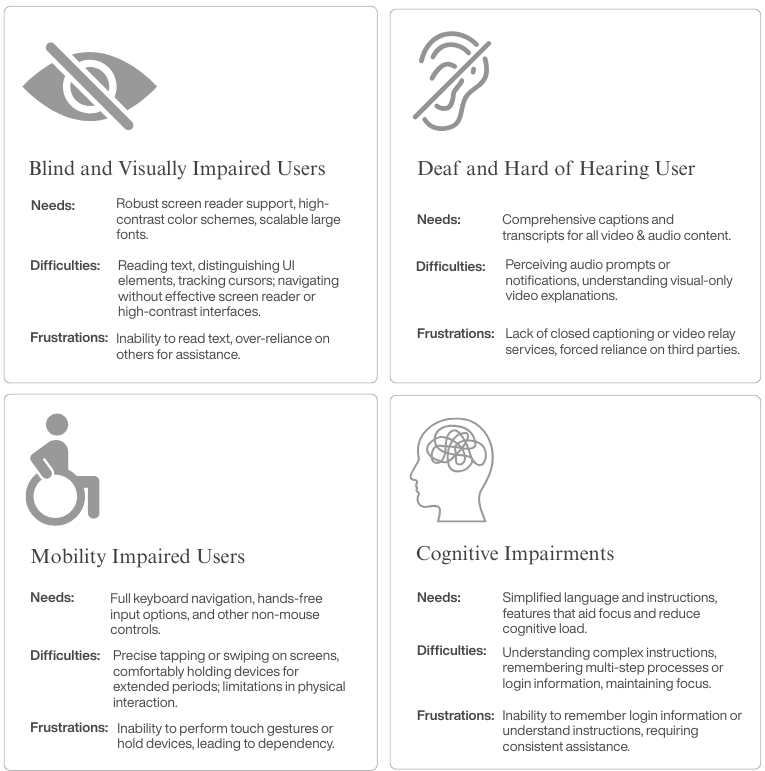

UNDERSTANDING THE DIVERSE NEEDS OF USERS

To design truly inclusively, we must deeply understand the specific challenges faced by

various user groups:

To design truly inclusively, we must deeply understand the specific challenges

faced by various user groups:

The project's key objectives are to:

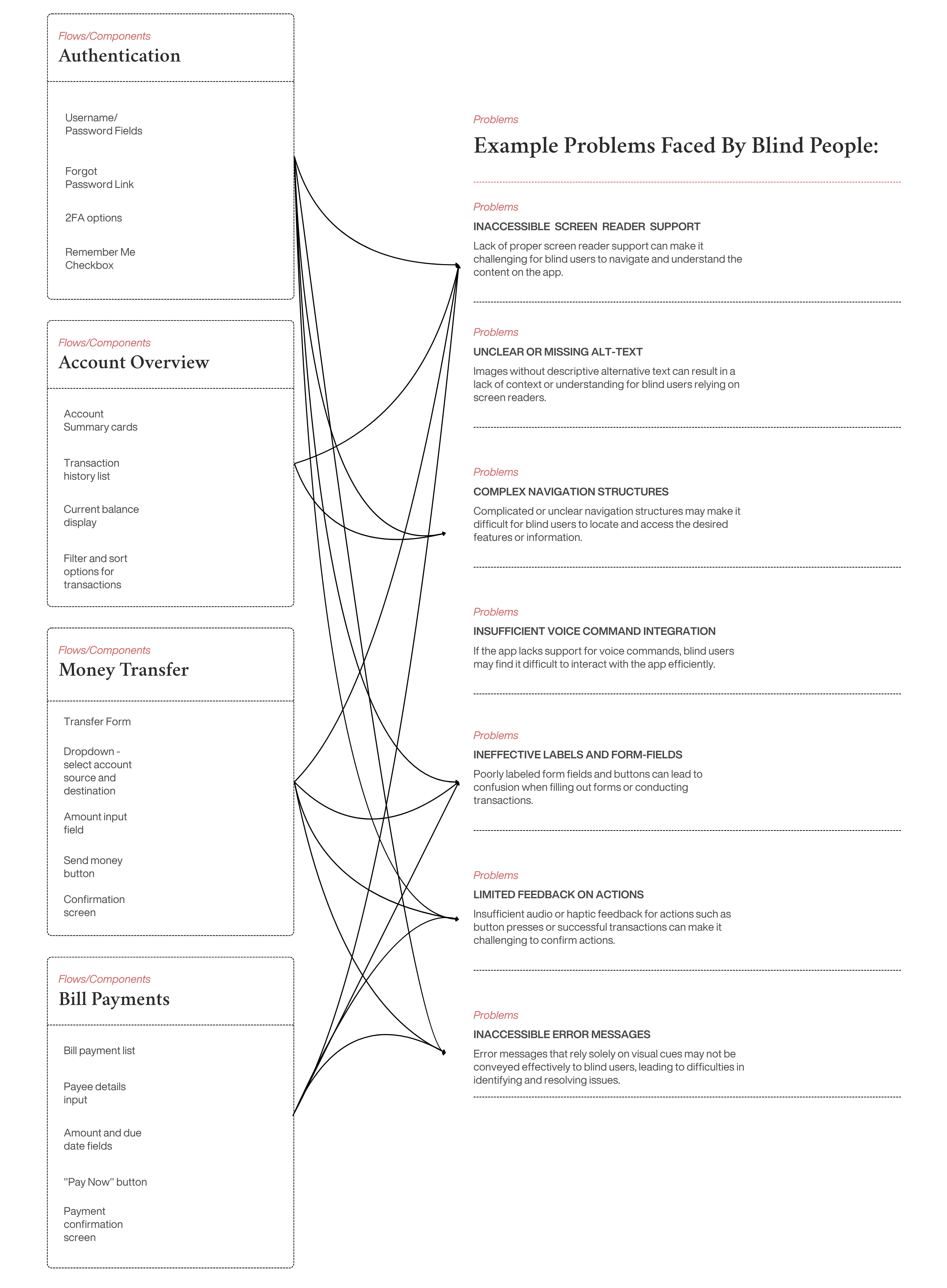

Identify Pain Points: Identify and prioritize specific

pain points

and challenges that users

currently face when interacting with the bank website.

Evaluate the effectiveness of the website's navigation system to:

Evaluate the effectiveness of the website's navigation system to

ensure users can easily find information and complete tasks.

Assess Transactional Workflows: Examine the user journey

through key transactional workflows, such

as fund transfers and bill payments, to identify potential obstacles and streamline processes.

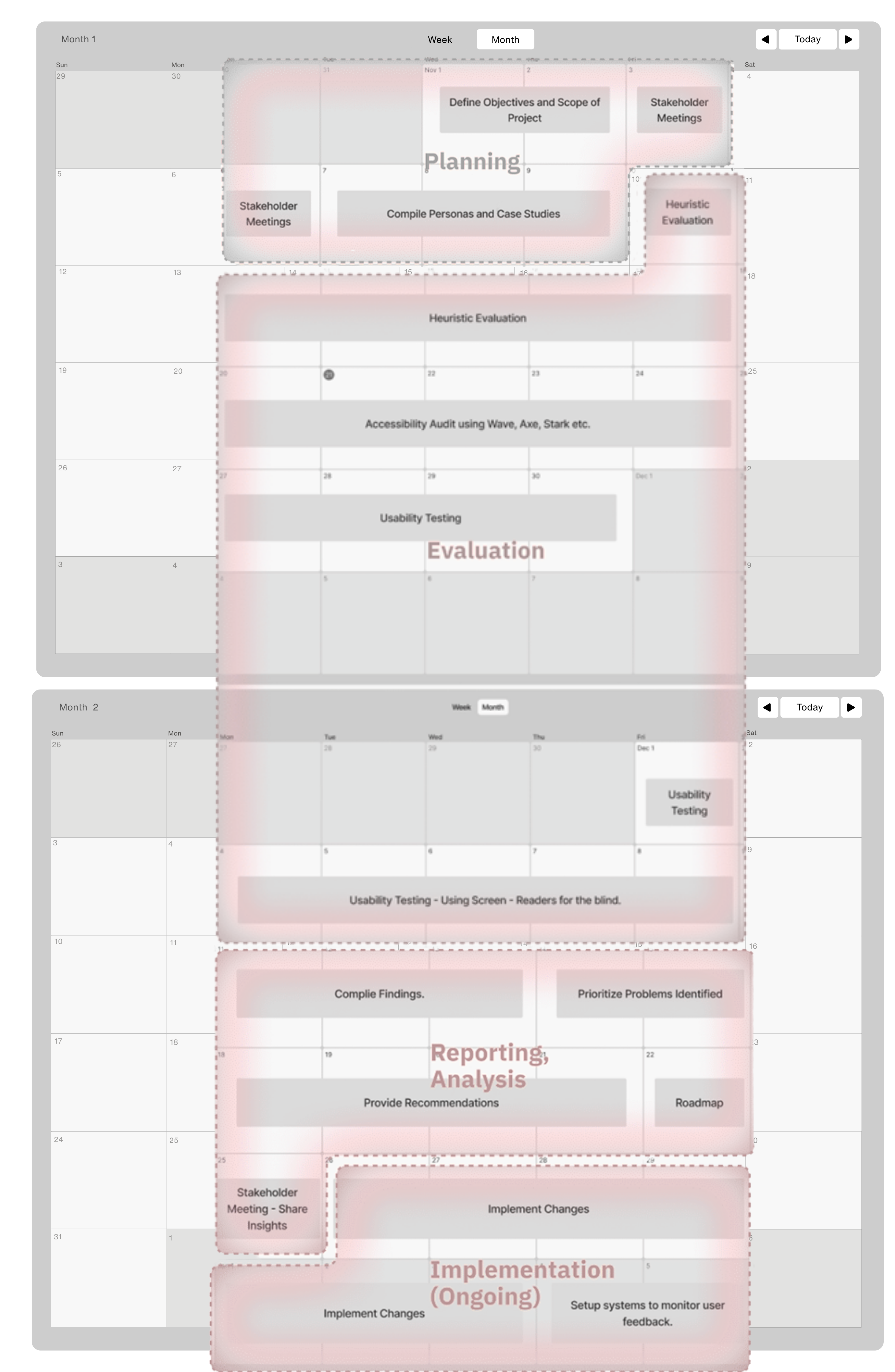

DEFINE: THE RESEARCH CHALLENGE IN ACTION

The foundation of any robust UX research lies in clearly defined objectives and a

well-structured methodology. My approach to this challenge is no exception.

☒ Assess Transactional Workflows -Assess user journeys for key

transactions like fund transfers and bill payments to find obstacles and streamline processes.

☒ Assess Navigation Effectiveness -Assess navigation system

effectiveness for easy information finding and task completion.

☒ Identify Pain Points -Identify Pain Points: Identify and

prioritize specific pain points and challenges that users currently face when interacting with the bank

website.